Inventory Management Models. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Operations Notes Inventory Management Mba Boost

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

. Ch Cost to hold one unit inventory for a year. The formula for EOQ is. Then we calculate Inventory Turnover Ratio using Formula.

As you can see Luxurious Furniture Company turnover is 29. O Ordering cost per order. As the name suggests these costs are variable in nature and changes with the increase or.

Unit Cost Variable Cost. Examples of Holding Cost. As per the latest annual report the following information is available.

Ordering Cost Fixed Cost C. The formula for fixed cost can be calculated by using the following steps. Current Yield 80 1000.

Cost of Goods Sold 10000. Cost of Goods Sold Formula Example 2. Let us take the example of Apple Incs annual report for 2019 to illustrate the calculation of different ratios used in ratio analysis.

H Holding cost per unit of the product. This should be based on your companys own cost of capital standards using the following formula. Fixed Cost Explanation.

The opportunity cost of holding inventory. How Economic Order Quantity is calculated. The club has also been holding a softball league with more than 30 players taking part in a tournament.

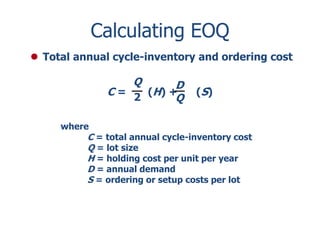

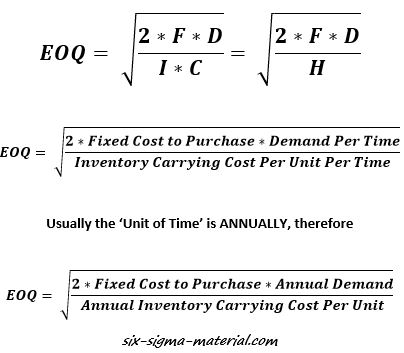

Lets take an example of HUL and assuming for the year 2017-18 beginning inventory was Rs 12000 Cr and ending inventory was Rs 15000 Cr. EOQ 2xDxO H ie. The key notations in understanding the EOQ formula are as follows.

Read more is as. D Annual demand in units of a product. Inventory management is a discipline primarily about specifying the shape and placement of stocked goods.

Finally divide the cost of goods sold. You can easily calculate the Opportunity Cost using Formula in the template provided. The holding cost ordering cost annual holding cost and total cost are all important components of an EOQ.

StudyCorgi provides a huge database of free essays on a various topics. Find any paper you need. ABC Inc is.

Inventory is the raw materials work-in-process products and finished goods that are considered to be the portion of a businesss assets that are ready or will be ready for sale. Cost of Goods Sold Beginning Inventory Purchases during the year Ending Inventory. Economic Order Quantity EOQ EOQ Formula.

Opportunity Cost Formula in Excel With Excel Template Here we will do the same example of the Opportunity Cost formula in Excel. Square root of 2xDxO H. Cp Cost to place a single order.

Current Yield 761 For Bond 2. The costs associated with breakage pilferage and deterioration of inventories. For the year 2019.

Inventory Turnover Ratio 029. Inventory Turnover Ratio Cost of Goods Sold Average Inventory. This formula aims at striking a balance between the amount you sell and the.

Usually pertains to the. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. The formula used to estimate EOQ EOQ Economic Order Quantity EOQ is a formula that calculates the optimal volume of production or order that an enterprise should add in order to minimize order expenses or holding costs.

Firstly determine the variable cost of production per unit which can be the aggregate of various cost of production such as labor cost raw material cost commissions etc. In the subsequent step we subtract by 1 to get 76 as the implied CAGR. Now let see another example to find ending inventory using FIFO LIFO and Weighted average method.

Annual Return Formula Example 2 Let us take the example of Dan who invested 1000 to purchase a coupon paying bond on January 1 2009. How to calculate the inventory turnover rate. Compound Annual Growth Rate CAGR 144 million 100 million1 5 Periods 1.

Get 247 customer support help when you place a homework help service order with us. Together the holding cost formula looks like this. It is required at different locations within a facility or within many locations of a supply network to precede the.

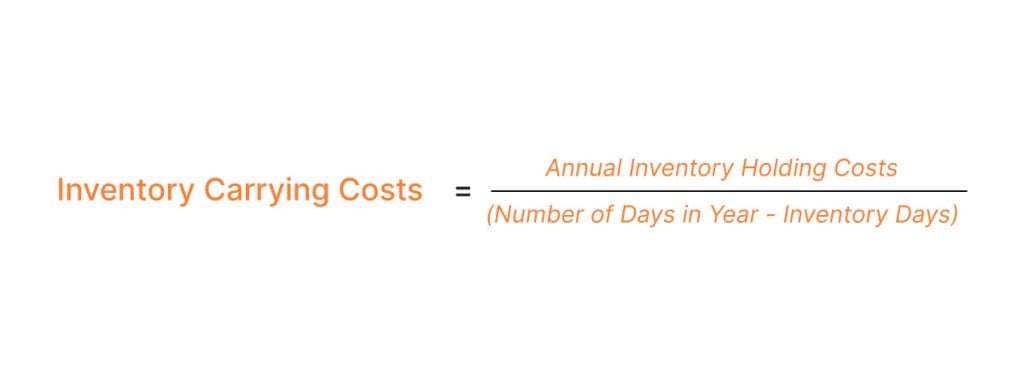

Calculate those subtotals add them together and then divide that sum by the total value of your annual inventory the combined average value of all inventory that you move in a year. Inventory Turnover Ratio 1000000 3500000. Inventory Holding Cost Formula Storage Cost Cost of Capital Insurance Taxes Obsolescence Cost.

Components of the EOQ Formula. Inventory American English or stock British English refers to the goods and materials that a business holds for the ultimate goal of resale production or utilisation. Total Relevant Cost TRC Yearly Holding Cost Yearly Ordering Cost Relevant because they are affected by the order quantity Q.

That number when expressed as a percentage is your inventory holding cost. Therefore the investor earned an annual return at the rate of 160 over the five-year holding period. Determine the total cost of goods sold cogs from your annual income statement.

Profitability from First Order is calculated using Opportunity Cost Formula. Persuasive argumentative narrative and more. Ending inventory 30000 Inventory Formula Example 2.

Lets discuss some examples. Ending inventory 50000 20000 40000. As per the CSCMPs 30th Annual State Logistics Report the total insurance and incurs the cost of US businesses were the US 14810 billion in 2018.

Economic Order Quantity EOQ is derived from a formula that consists of annual demand holding cost and order cost. It is very easy and simple. Cost of Capital x Average Net Value of Inventory 2.

Based on the given information calculate the liquidity solvency efficiency and profitability ratios of Apple Inc. Theres a simple formula to calculate the inventory formula ratio. The components of the formula that make up the total cost per order are the cost of holding inventory and the cost of ordering that inventory.

One needs to use the formula to arrive at the quantity as per this concept. Cost of Goods Sold 20000 5000 15000. Calculate the cost of average inventory by adding together the beginning inventory and ending inventory balances for a single month and divide by two.

Current Yield 727 For the next one year Bond 1 seems to be a better investment option given its relatively better current yield. Our CAGR formula divides 144 million the ending value by 100 million the beginning value and then raises it to 1 divided by 5 the number of periods. Current Yield 70 920.

Dog show helps gala raise the woof.

What Is Inventory Carrying Costs How To Measure And Reduce

Object Not Found Change Management Visual Learning Economic Order Quantity

0 Comments